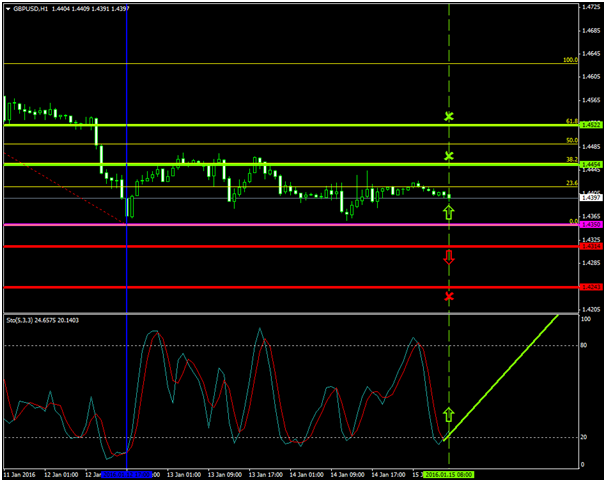

The sellers are still placing strong bearish pressures on the GBPUSD pair, as the price resumed to decline since the 8th of January 2016 from as high as 1.4628 to as low as 1.4350.

Today’s major pivot point area where both the buyers and the sellers will attempt to re-gain control is the 1.4350 level.

Probable Scenario

In the scenario where the buyers manage to generate a bullish momentum above the 1.4350 zone, the pair could accelerate to 1.4454 and 1.4522 respectively.

The Stochastic oscillator also confirms that a bullish retracement has greater probabilities to prevail at the 20 level.

Alternative Scenario

In contrast, in the condition where the buyers fail to take the lead over the price, the sellers could force the pair to lower areas such as the 1.4243 zone, provided that initially they are successful in a downside break at the 1.4314 level.

Today’s Major Announcements

- The Retail Sales ex Autos (MoM) (Dec), the Retail Control (Dec), and the Retail Sales (MoM) (Dec) announcements are expected to have a major impact on the U.S. dollar

- There are no any major announcements on the sterling

Synopsis

- Probable trend (Bullish):1.4350

- Bullish take profit targets: 1.4454, 1.4522

- Stop loss target: 1.4314

- Alternative trend (Bearish): 1.4314

- Bearish take profit target: 1.4243