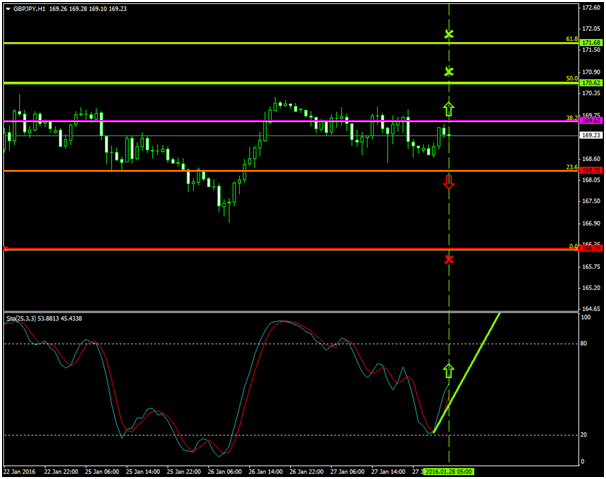

The GBPJPY has been lately oscillating around the 169.62 level which is today’s major pivot area where both the bulls and bears will likely place strong pressures to take control over the pair.

The buyers of the sterling were the big gainers, since the 26th of January 2016, as they have been able to lead the pair from as low as 166.90 to as high as 170.35.

Probable Scenario

In the event where the bulls are able, with an upside break, to withhold the pair above the 169.62 zone, the price could escalate to 170.62 Fibonacci 50.0%, and 171.68 Fibonacci 61.8%.

The Stochastic oscillator’s latest indication confirms that a probable bullish break-out at the 169.62 area has greater chances to prevail.

Alternative Scenario

Alternatively, in the scenario where the bearish pressures resume, the sellers could force the price below the 168.31 area and lower to 166.24.

Today’s Major Announcements

- The Gross Domestic Product (QoQ) (Q4) and the Gross Domestic Product (YoY) (Q4) announcements are expected to have a medium impact on the sterling

- The National Consumer Price Index (YoY) (Dec), the National CPI Ex-Fresh Food (YoY) (Dec), the National CPI Ex Food, Energy (YoY) (Dec), the Jobs/applicants ratio (Dec), the Unemployment rate (Dec), Overall Household Spending (YoY) (Dec), the Industrial Production (MoM) (Dec), and the Industrial Production (YoY) (Dec) releases are expected to have a medium impact on the Japanese yen

Synopsis

- Probable trend (Bullish):169.62

- Bullish take profit targets:170.62, 171.68

- Stop loss target:168.31

- Alternative trend (Bearish): 168.31

Bearish take profit target:166.24