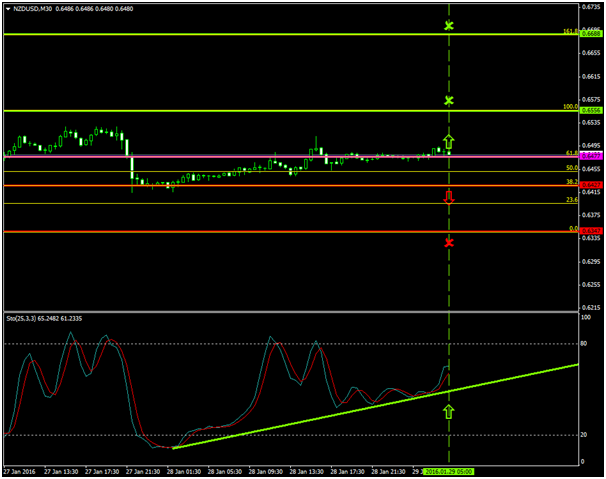

The NZDUSD pair lately oscillated above the 0.6477 level which is today’s major pivot zone and an area where both the bullish and the bearish pressures are expected get more tensed.

The sellers of the New Zealand dollar were the gainers, since the 27th of January 2016, as they have been able to force the pair to 0.6427.

What may happen next? Is it about time for the buyers to retrace the price to the upside?

Probable Scenario

In the scenario where the buyers are able to withhold the pair above the 0.6477 level, the price could appreciate to 0.6556 Fibonacci’s 100.0%, and 0.6688 Fibonacci’s 161.8%.

The Stochastic oscillator’s latest indication confirms that a probable bullish retracement at the 0.6477 area has greater chances to prevail.

Alternative Scenario

Alternatively, in the event where the bearish pressures increase, and the sellers force the pair below the 0.6427 area, the price could decline to 0.6347.

Today’s Major Announcements

- The Gross Domestic Product Price Index (Q4) and the Gross Domestic Product Annualized (Q4) announcements are expected to have a strong impact on the U.S. dollar

- There are no any major announcements that may have a strong impact on the New Zealand dollar

Synopsis

- Probable trend (Bullish):0.6477

- Bullish take profit targets:0.6556, 0.6688

- Stop loss target:0.6427

- Alternative trend (Bearish): 0.6427

Bearish take profit target:0.6347