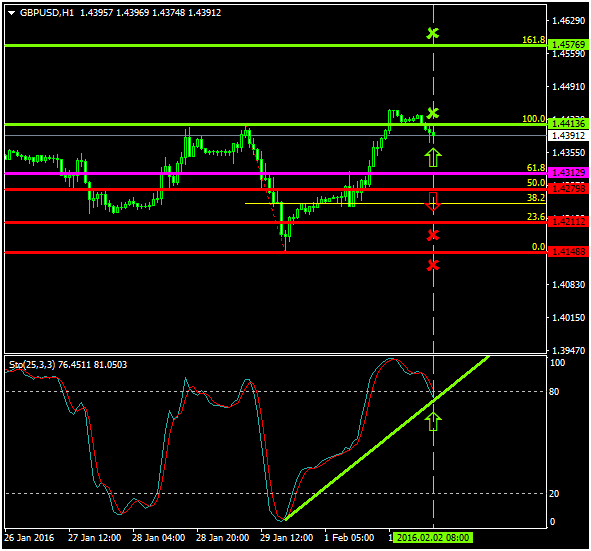

The euro and the sterling have been recently oscillating between the range of 1.4148 and 1.4413 respectively.

Both the bulls and the bears have placed equal pressures in their attempts of taking control over the price.

The upside pressures led the pair, in some cases, slightly above the 1.4413level whereas the downside ones forced the price down to the 1.4148 zone.

Probable Scenario

In the scenario where the GBPUSD retraces and stabilizes above the 1.4312 area, the price could re-escalate to 1.4413, Fibonacci’s 100.0%, and 1.4576, Fibonacci’s 161.8%.

The stochastic oscillator, even though the price has already approached close to the 80 level, indicates that the pair has greater chances of appreciating to upper levels.

Alternative Scenario

Alternatively, should the sellers take the lead and force the price below the 1.4279 area, the pair could decline as low as 1.4211 and 1.4148?

Today’s Major Announcements

- The PMI Construction (Jan) announcement is expected to have a medium impact on the sterling

- The API Weekly Crude Oil Stock release is expected to have a medium impact on the U.S. dollar

Synopsis

- Probable trend (Bullish): 1.4312

- Bullish take profit targets: 1.4413, 1.4576

- Stop loss target: 1.4279

- Alternative trend (Bearish): 1.4279

- Bearish take profit targets: 1.4211, 1.4148