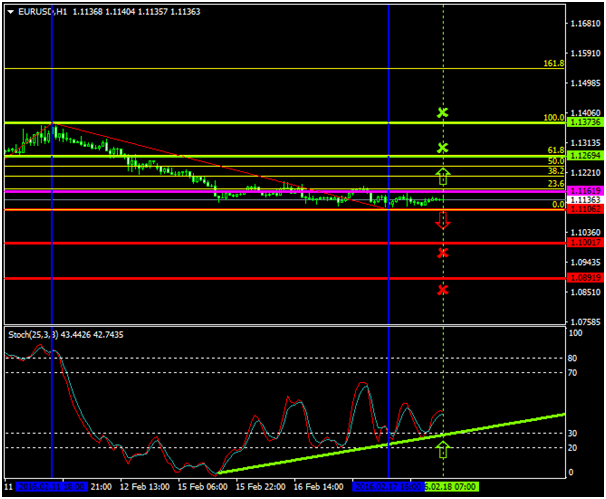

The EURUSD has been, since the 11th of February 2016, under strong downside pressures that have forced the price to drop to 1.1106.

Will the bearish momentum resume or can the buyers retrace the price to the upside taking advantage of today’s major pivot point area 1.1161?

Probable Scenario

The latest stabilization of the pair close to the 1.1161 level and the latest minor bullish momentum is an indication that the buyers may exert pressures to lead the price to the upside.

The Stochastic oscillator has also confirmed that the price could aggressively escalate as the pair has already approached oversold levels.

In the scenario where the pair breaks above the 1.1161 area, the price could rise to 1.1269, Fibonacci’s 61.8%, and 1.1373, Fibonacci’s 100.0%.

Alternative Scenario

Alternatively, in the event where the buyers are not able to hold the price close to the 1.1161 area and the sellers place greater pressures, the pair could decelerate to 1.1001 and 1.0891, provided that the price breaks and stabilizes below the 1.1106 level.

Today’s Major Announcements

- The ECB Monetary Policy Meeting Accounts release is expected to have a strong impact on the euro

- The Initial Jobless Claims (Feb 12), the Continuing Jobless Claims (Feb 5), the Philadelphia Fed Manufacturing Survey (Feb), the CB Leading Indicator (MoM) (Jan), and the EIA Crude Oil Stocks Change (Feb 12) announcements are expected to have a medium impact on the U.S. dollar

Synopsis

- Probable trend (Bullish):1.1161

- Bullish take profit targets:1.1269, 1.1373

- Stop loss target:1.1106

- Alternative trend (Bearish): 1.1106

- Bearish take profit targets:1.1001, 1.0891