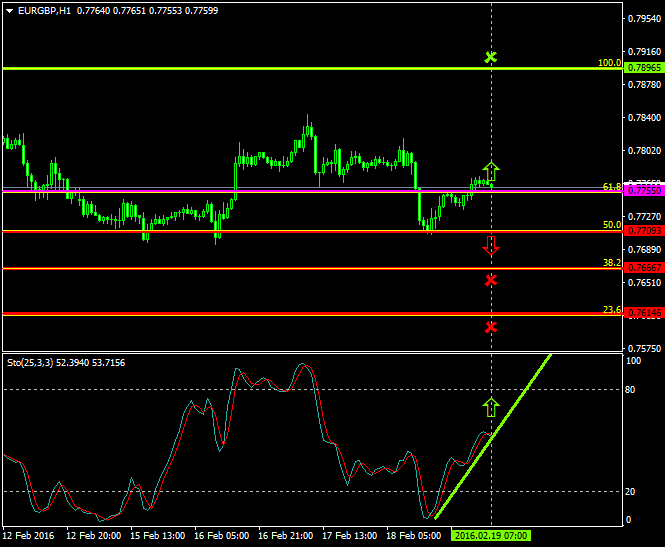

The buyers of the euro were the profit makers since the 15th of February 2016, whereas the sellers lost ground, either having made a minor profit on the retracements or faced loses.

The pair is now oscillating between the range of 0.7709 and 0.7755 respectively.

The price has currently stabilized close to the 0.7755 level which is today’s major pivot point area.

Probable Scenario

In the scenario where the buyers are able to withhold the pair close to the 0.7755 zone, they could boost the price to upper areas such as the 0.7896 level, Fibonacci’s 100.0%.

Alternative Scenario

In contrast, in the condition where today’s events and announcements turn the EURGBP bearish, the price could drop as low as 0.7666 and 0.7614 after an aggressive downside break at the 0.7709 zone.

Today’s Major Announcements

- The Producer Price Index (MoM) (Jan), the Producer Price Index (YoY) (Jan), and the European Council Meeting releases are expected to have a medium impact on the euro

The Public Sector Net Borrowing (Dec) announcement is expected to have a medium impact on the sterling

Synopsis

- Probable trend (Bullish): 0.7755

- Bullish take profit target: 0.7896

- Stop loss target: 0.7709

- Alternative trend (Bearish): 0.7709

- Bearish take profit targets: 0.7666, 0.7614