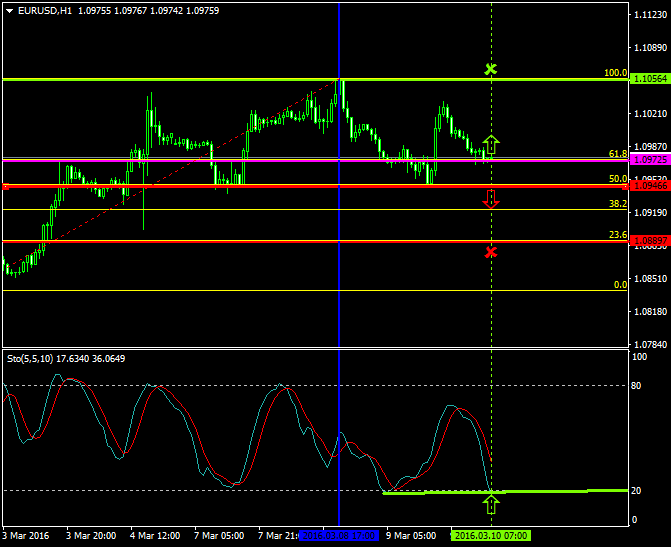

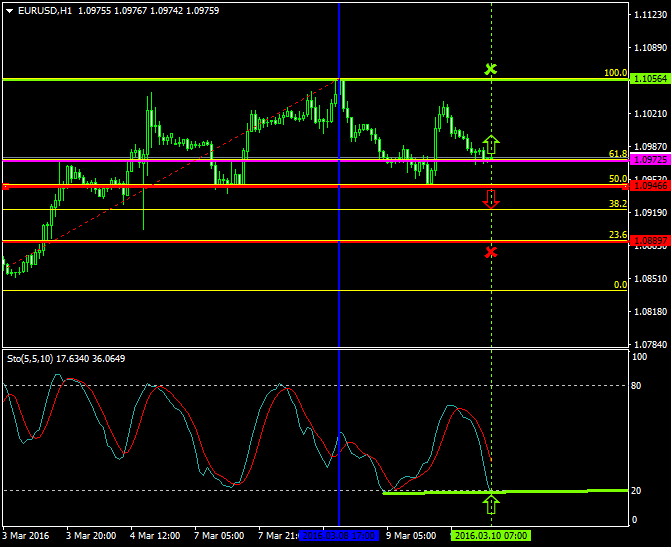

The price is in a constant rising mode as the bulls have been able to patiently and steadily lead the pair to higher zones.

The pair has slightly escalated, since yesterday’s trading session, from as low as 1.0946 to as high as 1.1034.

Stabilization and minor bullish attempts are surfacing again at the 1.0972 level which is today’s major pivot point area.

Probable Scenario

In the condition where the bulls are able to withhold the price close to the 1.0972 zone and exert greater pressures, the pair could appreciate to 1.1056.

Similarly, the Stochastic oscillator indicates that the pair has greater probabilities of retracing to the upside at the 20 level.

Alternative Scenario

In contrast, in the scenario where the pair drops to the 1.0946 area and the bears place more pressures taking advantage of the bearish volatility, the price could decelerate to the 1.0889 zone.

Today’s Major Announcements

- The ECB Interest Rate Decision (Mar 10), the ECB Deposit Rate Decision (Mar 10), and the ECB Monetary Policy Statement and Press Conference announcements will likely have a major impact on the euro

- The Monthly Budget Statement (Feb) release is expected to have a medium impact on the U.S. dollar

Synopsis

- Probable trend (Bullish): 1.0972

- Bullish take profit target: 1.1056

- Stop loss target: 1.0946

- Alternative trend (Bearish): 1.0946

- Bearish take profit target: 1.0889