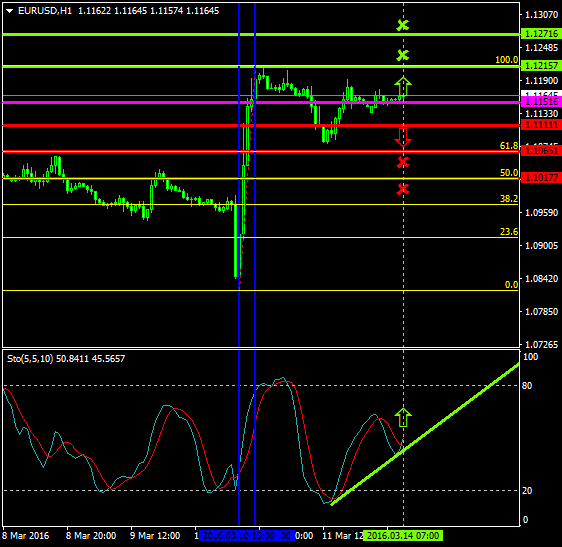

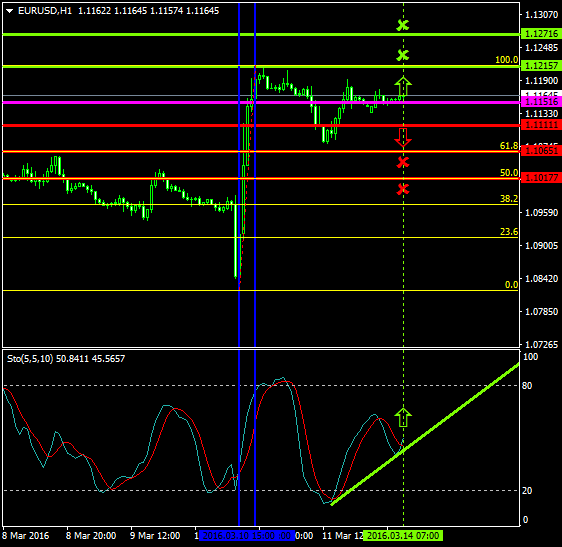

The EURUSD has been lately oscillating between the range of 1.1215 and 1.1077 as both the bulls and the bears were able to make a profit from the bullish and the bearish swing patterns in place.

The price is currently oscillating slightly above today’s major pivot point area which is the 1.1151 level.

Probable Scenario

The latest stabilization of the pair above the 1.1151 area is a good indication that the price may retrace once again to the upside.

In the scenario where the price appreciates, the buyers could lock their profit at 1.1215 and 1.1271.

The Stochastic oscillator confirms the uptrend condition thus showing that the price has already approached oversold zones close to the 50 level.

Alternative Scenario

In contrast, in the event where the sellers resume their bearish pressures and the price declines below the 1.1111 zone, the pair could drop to 1.1065 and 1.1017.

Today’s Major Announcements

- The Industrial Production w.d.a. (YoY) (Jan) and the Industrial Production s.a (MoM) (Jan) releases are expected to have a medium influence on the euro

- There are no any releases that could have an impact on the U.S. dollar

Synopsis

- Probable trend (Bullish): 1.1151

- Bullish take profit targets: 1.1215, 1.1271

- Stop loss target: 1.1111

- Alternative trend (Bearish): 1.1111

- Bearish take profit targets: 1.1065, 1.1017