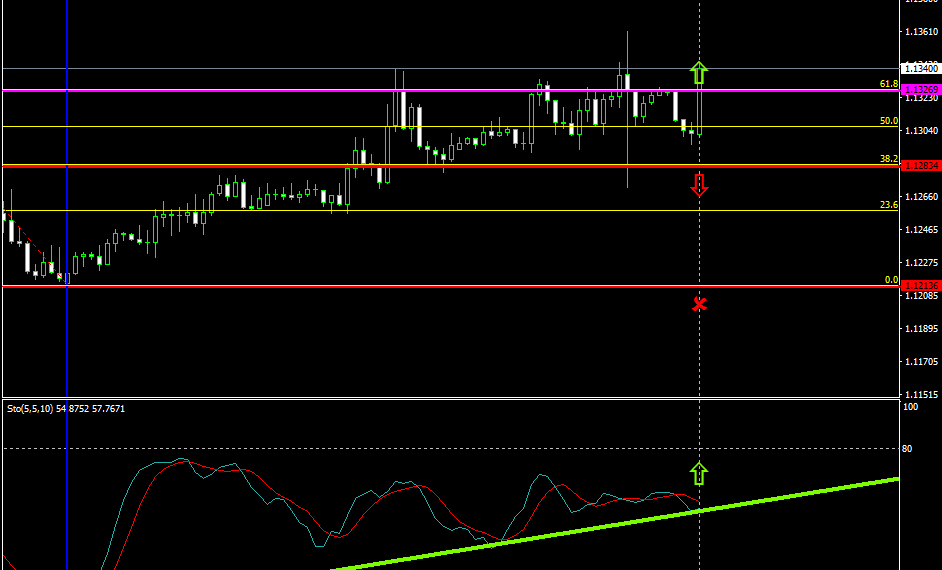

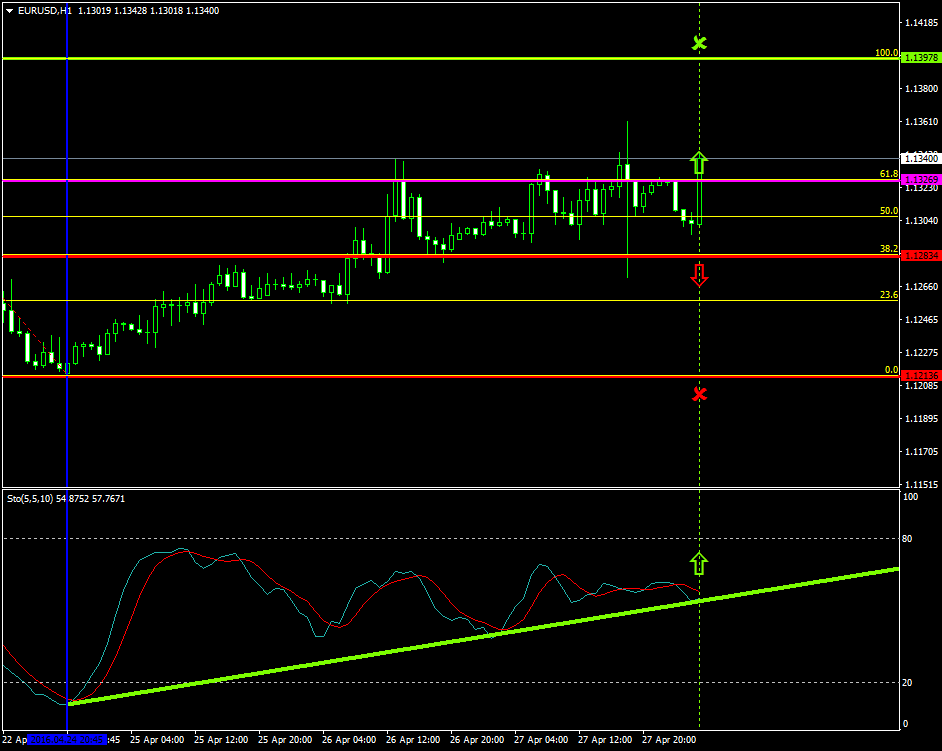

The EURUSD after having risen from as low as 1.1213 to as high as 1.1326 has now stabilized slightly above today’s major pivot point area, the 1.1326 level.

Stochastic oscillator’s latest formation shows a pattern of a steady appreciation at the 70 level where the pair is expected to retrace to the upside.

Probable Scenario

In the condition where the pair stabilizes above the 1.1326 level and the upside pressures somehow get more tensed, the price could rise to the 1.1397 zone, Fibonacci’s 100.0%.

Should the bulls gain the control over the price in today’s session too, then such formation will confirm the uptrend success since the 24th of April 2016.

Alternative Scenario

Alternatively, in the event where the bearish pressures force the pair below the 1.1283 zone, the price could drop to 1.1213.

Today’s Major Announcements

- Germany’s Unemployment Change (Apr), Unemployment Rate s.a. (Apr), Euro zone’s Services Sentiment (Apr), Consumer Confidence (Apr), Industrial Confidence (Apr), Economic Sentiment Indicator (Apr), Business Climate (Apr), and Germany’s Consumer Price Index (YoY) (Apr)P, Harmonised Index of Consumer Prices (MoM) (Apr)P, Harmonised Index of Consumer Prices (YoY) (Apr)P, and Consumer Price Index (MoM) (Apr)P releases are expected to have a medium impact on the euro

- U.S.’s Initial Jobless Claims (Apr 22), the Continuing Jobless Claims (Apr 15), the Gross Domestic Product Price Index (Q1)P, the Gross Domestic Product Annualized (Q1)P, the Personal Consumption Expenditures Prices (QoQ) (Q1), and the Core Personal Consumption Expenditures (QoQ) (Q1)P releases are expected to have a medium impact on the U.S. dollar

Synopsis

- Probable trend (Bullish): 1.1326

- Bullish take profit target: 1.1397

- Stop loss target: 1.1283

- Alternative trend (Bearish): 1.1283

- Bearish take profit target: 1.1213