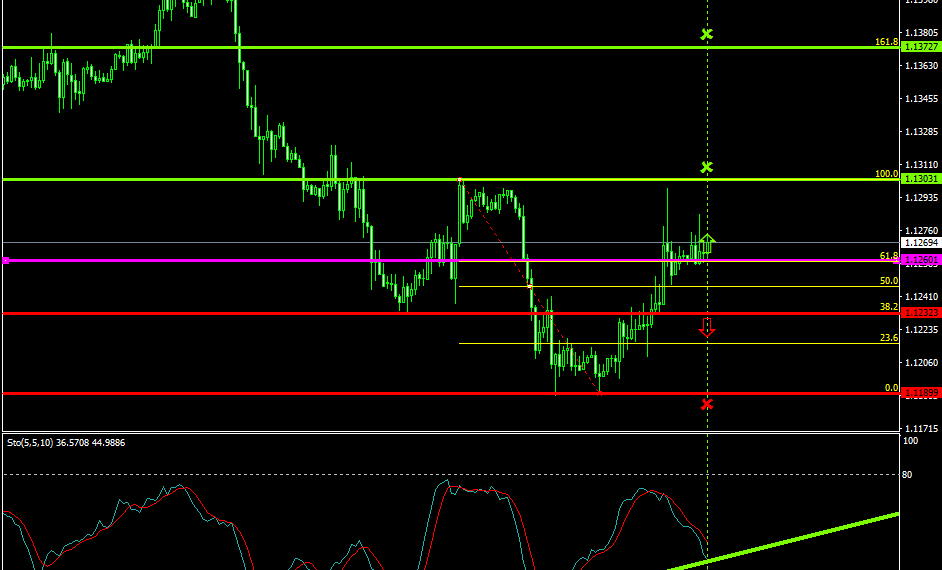

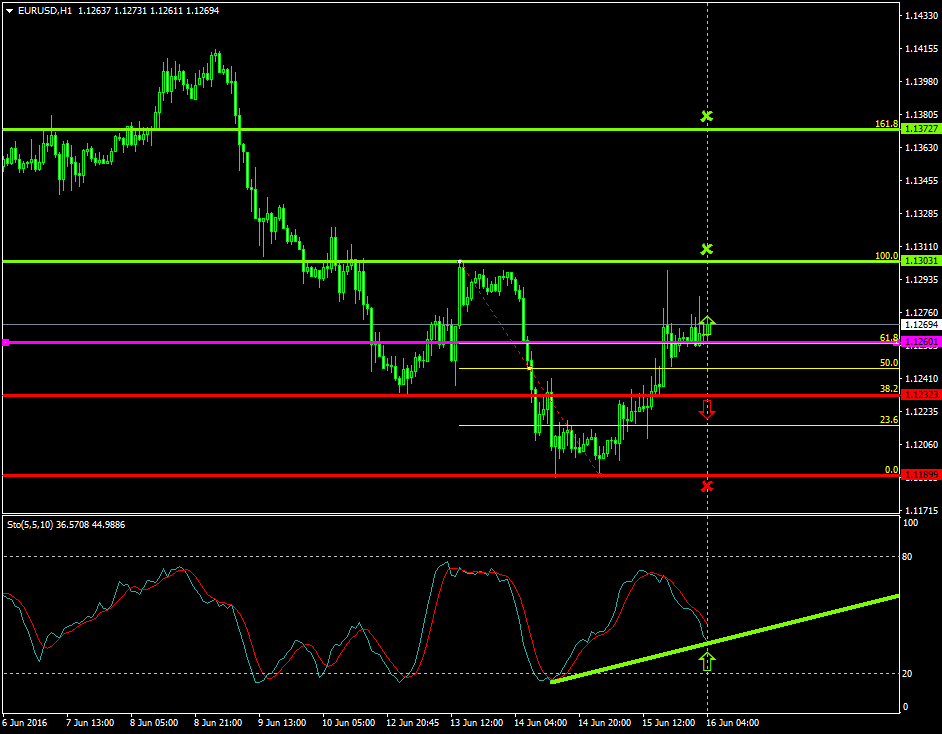

The price is in a constant acceleration mode as the buyers have been able to patiently and steadily lead the pair to higher zones.

The pair has escalated, since yesterday’s trading session, from as low as 1.1189 to as high as 1.1297.

Stabilization and minor bullish attempts are surfacing again, slightly, at the 1.1260 level which is today’s major pivot point area.

Probable Scenario

In the condition where the bulls are able to withhold the price above the 1.1260 zone and exert greater pressures, the pair could appreciate to 1.1303 and 1.1372.

Similarly the Stochastic oscillator indicates that the pair has greater probabilities of retracing to the upside at the 30 level.

Alternative Scenario

In contrast, in the scenario where the pair drops to the 1.1232 area and the bears place more pressures, taking advantage of the bearish volatility, the price could decelerate to the 1.1189 zone.

Today’s Major Announcements

- Euro zone’s Consumer Price Index (YoY) (May), the Consumer Price Index – Core (MoM) (May), the Consumer Price Index (MoM) (May), Consumer Price Index – Core (YoY) (May), the Euro group meeting, and the Economic Bulletin releases are expected to have a medium impact on the euro

- U.S.’s Initial Jobless Claims (June 10), the Consumer Price Index Ex Food & Energy (MoM) (May), the Consumer Price Index (YoY) (May), the Consumer Price Index Ex Food & Energy (YoY) (May), Consumer Price Index (MoM) (May), Consumer Price Index n.s.a (MoM) (May), Consumer Price Index Core s.a (May), the Philadelphia Fed Manufacturing Survey (Jun), and the NAHB Housing Market Index (Jun) announcements will likely have a medium impact on the U.S. dollar

Synopsis

- Probable trend (Bullish): 1.1260

- Bullish take profit targets: 1.1303, 1.1372

- Stop loss target: 1.1232

- Alternative trend (Bearish): 1.1232

- Bearish take profit target: 1.1189