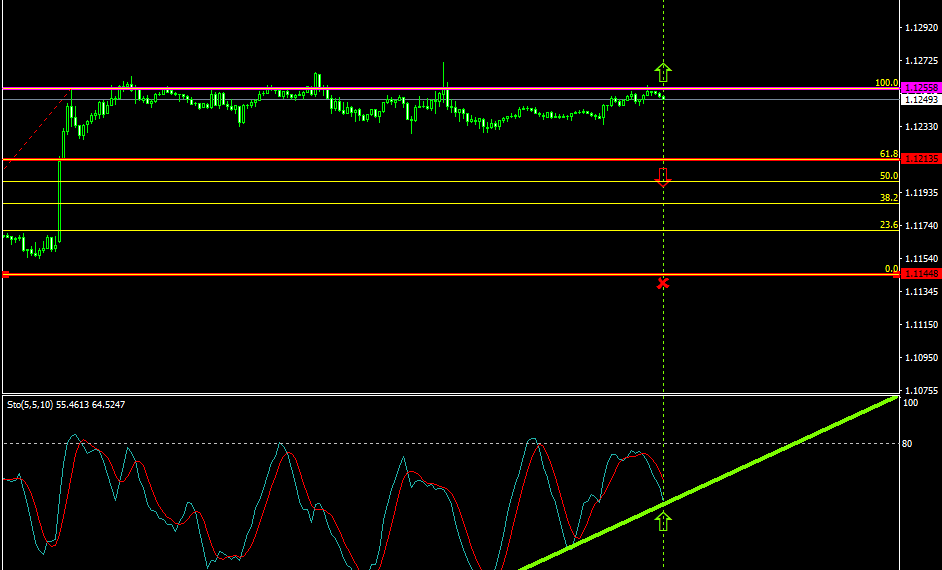

The euro and the U.S. dollar are lately oscillating between the range of 1.1144 and 1.1255 respectively.

The bulls, since the 6th of September 2016, have placed strong pressures in their attempts of taking control over the price, and managed to force the pair from 1.1144 to 1.1255.

Probable Scenario

In the scenario where the EURUSD stabilizes above the 1.1255 area, the price could escalate as high as 1.1324.

The Stochastic oscillator indicates that the pair has greater chances of appreciating to upper levels at the 60 zone.

Alternative Scenario

Alternatively, should the sellers take the lead and force the price below the 1.1213 area the pair could decline as low as 1.1144.

Today’s Major Announcements

- The ECB Interest Rate Decision (Sep 8), the ECB deposit rate decision, and the ECB Monetary policy statement and press conference releases are expected to have a strong impact on the euro

- The U.S.’s Continuing Jobless Claims, the Initial Jobless Claims (Sep 2), the EIA Crude oil Stocks Change (Sep 2), and the Consumer Credit Change (Aug) announcements will likely a have medium impact on the U.S. dollar

Synopsis

- Probable trend (Bullish): 1.1255

- Bullish take profit targets: 1.1324

- Stop loss target: 1.1213

- Alternative trend (Bearish): 1.1213

- Bearish take profit target: 1.1144