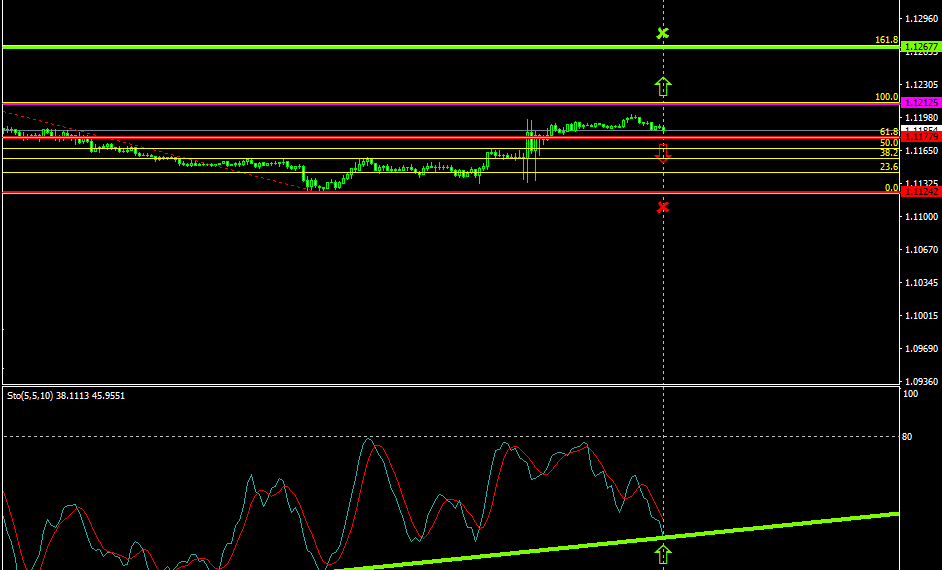

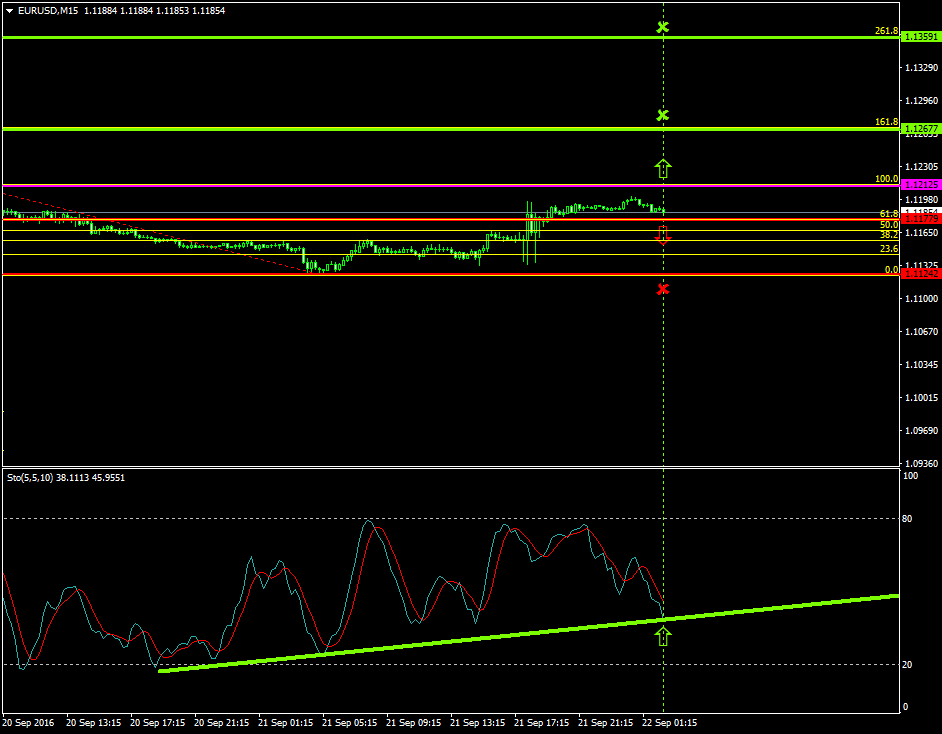

The upside pressures on the pair got more tensed since the 21st of September 2016 where the price climbed from as low as 1.1124 to as high as 1.1200.

The bulls took control over the pair by more than 70 pips to their favour, a movement with satisfactory gains for the buyers but losses for the sellers.

Probable Scenario

The latest stabilization of the price close to the 1.1212 zone, which is today’s major pivot point level, is a good indication that the bulls could likely exert further momentum to boost the price upwards.

Stochastic oscillators’ formation signals that a probable bullish retracement, close to the 35 level, has greater chances to occur.

In the event where the pair escalates, the buyers could set their take profit targets at 1.1267 and 1.1359.

Alternative Scenario

Alternatively, a bearish break-out below the 1.1177 zone could signal that the sellers may exert far greater pressures to force the price to lower areas such as the 1.1124.

Today’s Major Announcements

- The ECB President Draghi’s Speech announcement could strongly impact the euro

- The Chicago Fed National Activity Index (Aug), the Initial Jobless Claims (Sep 16), the Housing Price Index (MoM) (Jul), and the CB Leading Indicator (MoM) (Aug) releases are expected to have a medium influence on the U.S. dollar

Synopsis

- Probable trend (Bullish): 1.1212

- Bullish take profit targets: 1.1267, 1.1359

- Stop loss target: 1.1177

- Alternative trend (Bearish): 1.1177

- Bearish take profit target: 1.1124