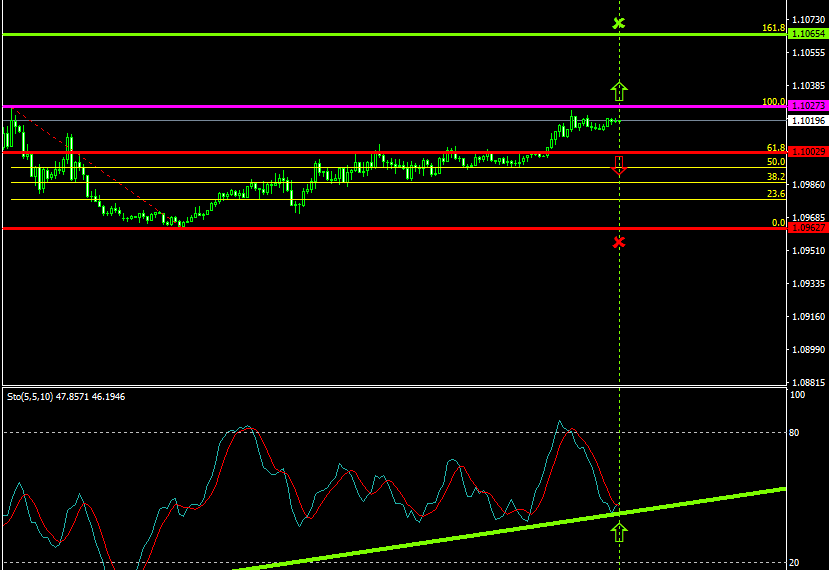

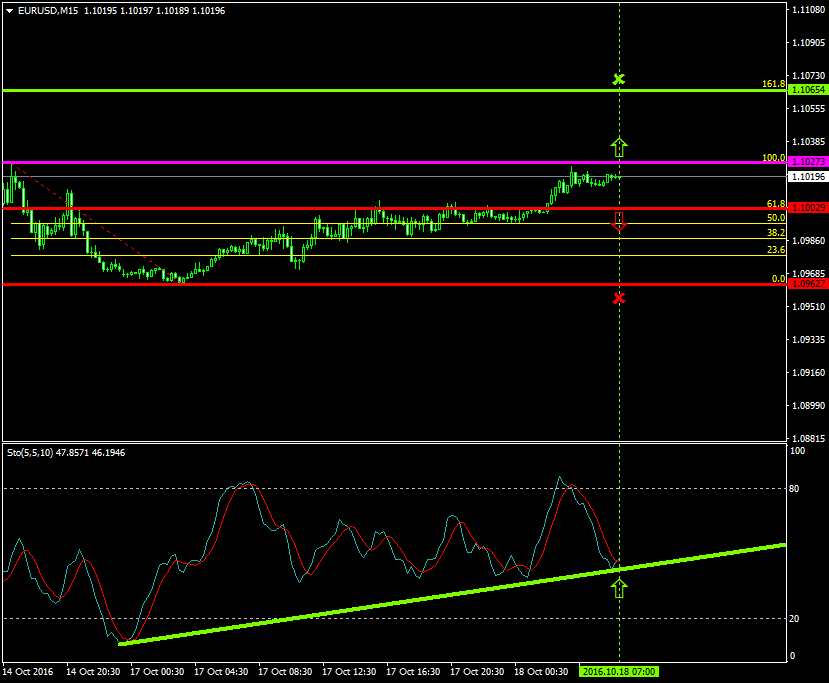

The upside pressures on the pair got more tensed since the 17th of October 2016 where the price climbed from as low as 1.0962 to as high as 1.1027.

The bulls took control over the pair by more than 50 pips to their favour, a movement with satisfactory gains for the buyers but losses for the sellers.

Probable Scenario

The latest stabilization of the price close to the 1.1027 zone, which is today’s major pivot point level, is a good indication that the bulls could likely exert further momentum to boost the price upwards.

Stochastic oscillators’ formation signals that a probable bullish retracement, close to the 40 level, has greater chances to occur.

In the event where the pair escalates, the buyers could set their take profit target at 1.1065.

Alternative Scenario

Alternatively, a bearish break-out below the 1.1002 zone could signal that the sellers may exert far greater pressures to force the price to lower areas such as the 1.0962.

Today’s Major Announcements

- There are no any announcements that could have a strong impact on the euro

- The Consumer Price Index Core s.a. (Sep), the Consumer Price Index n.s.a (MoM) (Sep), the Consumer Price Index (MoM) (Sep), the Consumer Price Index Ex Food & Energy (MoM) (Sep), the Consumer Price Index Ex Food & Energy (YoY) (Sep), the Consumer Price Index (YoY) (Sep), and the NAHB Housing Market Index (Oct) releases are expected to have a medium influence on the U.S. dollar

Synopsis

· Probable trend (Bullish): 1.1027

· Bullish take profit target: 1.1065

· Stop loss target: 1.1002

· Alternative trend (Bearish): 1.1002

· Bearish take profit target: 1.0962