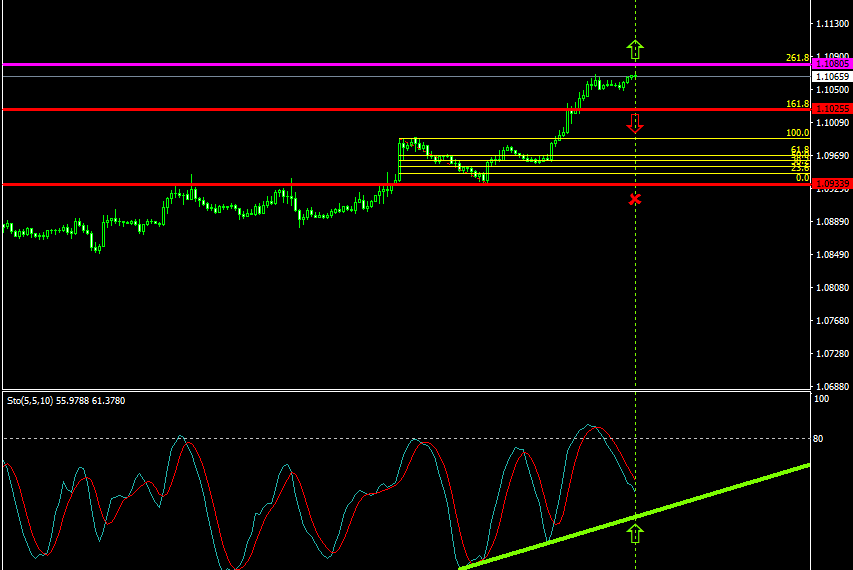

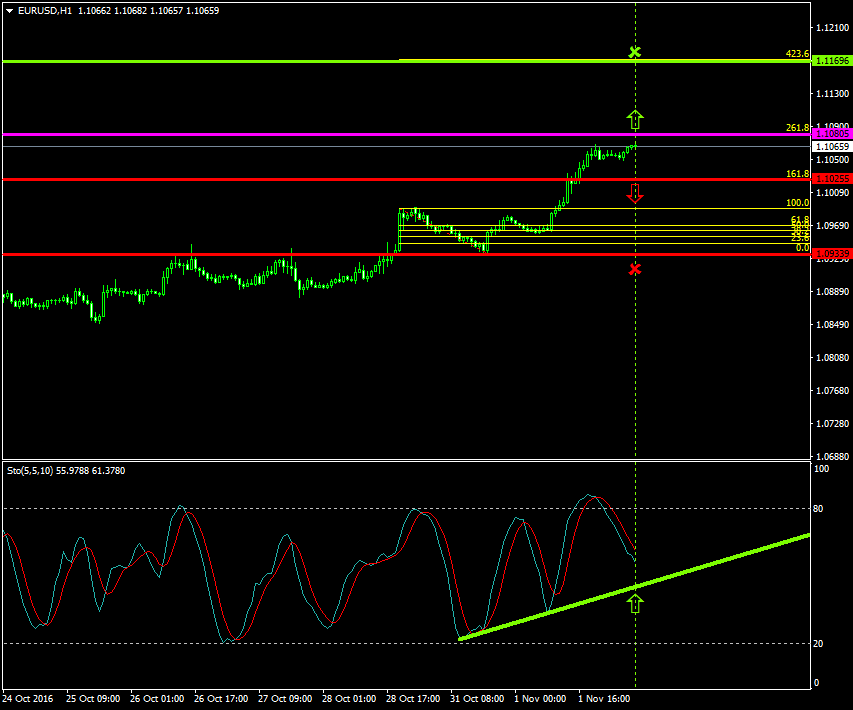

The pair is oscillating within an upside formation as the buyers have managed to boost the price close to the 1.1080 level.

The price has initially climbed, since the 1st of November 2016, from as low as 1.0933 to as high as 1.1080.

Stabilization and minor bullish attempts are surfacing again slightly close to the 1.1080 level.

Probable Scenario

In the condition where the bulls are able to withhold the price close to the 1.1080 level and exert greater pressures, the pair could appreciate to 1.1169.

Similarly the Stochastic oscillator indicates that the price has greater probabilities to escalate at the 60 level.

Alternative Scenario

In contrast, in the scenario where the pair drops to the 1.1025 area, the bears may place more pressures, and the price could decelerate to 1.0933.

Today’s Major Announcements

- Germany’s Unemployment Rate s.a (Oct), the Unemployment Change (Oct), the Markit Manufacturing PMI (Oct), and the euro zone’s Markit Manufacturing PMI (Oct) releases are expected to have a medium influence on the euro

- The Fed’s Monetary Policy Statement and the Fed Interest Rate Decision releases are expected to have a medium influence on the U.S. dollar

Synopsis

· Probable trend (Bullish): 1.1080

· Bullish take profit target: 1.1169

· Stop loss target: 1.1025

· Alternative trend (Bearish): 1.1025

· Bearish take profit targets: 1.0933