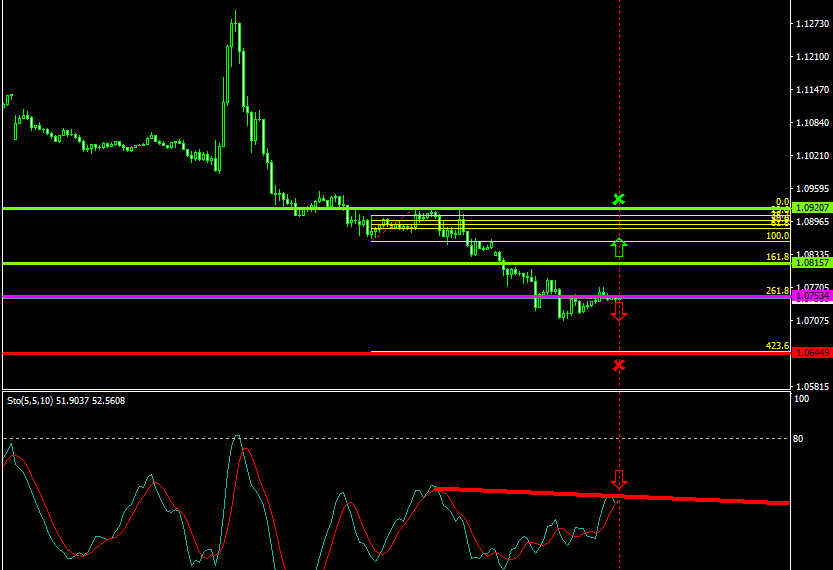

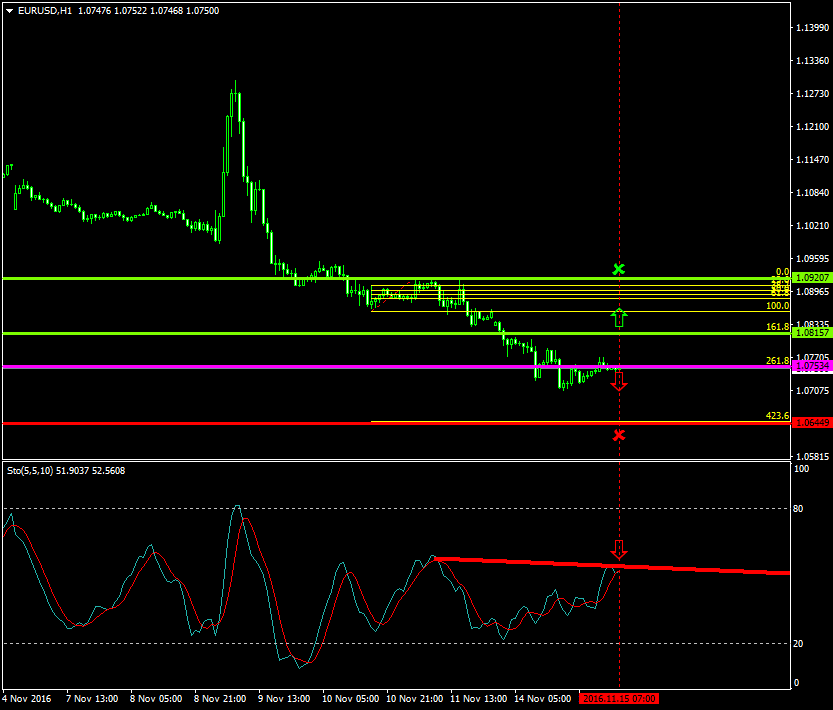

The EURUSD stabilized close to the 1.0753 zone, Fibonacci’s 261.8%, where the sellers will likely place more pressures to take control of the price.

The price, since the 10th of November 2016, has been oscillating within a downside formation between the range of 1.0920 and 1.0753 respectively.

Probable Scenario

The latest formation and stabilization below the 1.0753 level is a good indication that the sellers may take control over the pair in today’s trading session.

In the event where the pair drops and the sellers take over, the price could decline to 1.0644 Fibonacci’s 423.6%.

The Stochastic oscillator’s main and signal lines indicate that the price has greater probabilities to decelerate at the 55 zone.

Alternative Scenario

Alternatively, in the scenario where the bulls are able to place greater pressures and the pair breaks above the 1.0815 area, the price could rise to 1.0920 Fibonacci’s 0.0%.

Today’s Major Announcements

- The euro zone’s GDP s.a. (QoQ) (Q3) and the GDP s.a. (YoY) (Q3) releases are expected to have a strong influence on the euro

- The Retail Sales ex Autos (MoM) (Oct), the Retail Sales Control Group (Oct), and the Retail Sales (MoM) (Oct) releases are expected to have a strong influence on the U.S. dollar

Synopsis

· Probable trend (Bearish): 1.0753

· Bearish take profit target: 1.0644

· Stop loss target: 1.0815

· Alternative trend (Bullish): 1.0815

· Bullish take profit target: 1.0920