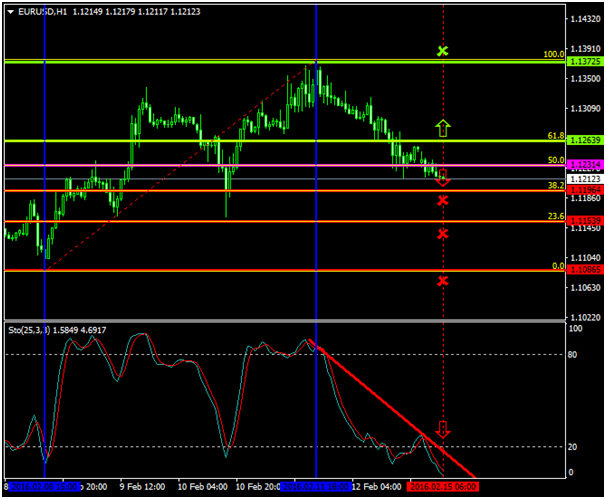

The EURUSD pair has been, since the 11th of February 2016, under strong downside pressures that forced the price to drop from the 1.1372 zone to the 1.1212 level.

Will the bearish momentum resume or could the bulls retrace the price to the upside taking advantage of today’s major pivot point area the 1.1231 level?

Probable Scenario

The latest stabilization of the pair below but close to the 1.1231level could be a good indication that the sellers may exert greater pressures to force the price once again to the downside.

The Stochastic oscillator has also confirmed that the price could aggressively decelerate, even though the pair has already approached oversold zones close to the 20 level.

In the scenario where the pair remains below the 1.1231 area, the price could drop to 1.1196 Fibonacci’s 38.2%, 1.1153 Fibonacci’s 23.6%, and 1.1086 Fibonacci’s 0.0%.

Alternative Scenario

Alternatively, in the event where the sellers are not able to hold the price close to the 1.1231 area and the buyers place greater pressures, the pair could rise as high as 1.1372, provided that initially there was a successful break above the 1.1263 zone.

Today’s Major Announcements

- There are no any major announcements that could strongly impact the U.S. dollar

- The ECB President Draghi’s Speech release is expected to have a strong impact on the euro

Synopsis

- Bearish take profit targets:1.1196, 1.1153, 1.1086

- Stop loss target:1.1263

- Alternative trend (Bullish): 1.1263Probable trend (Bearish):1.1231

- Bullish take profit target:1.1372