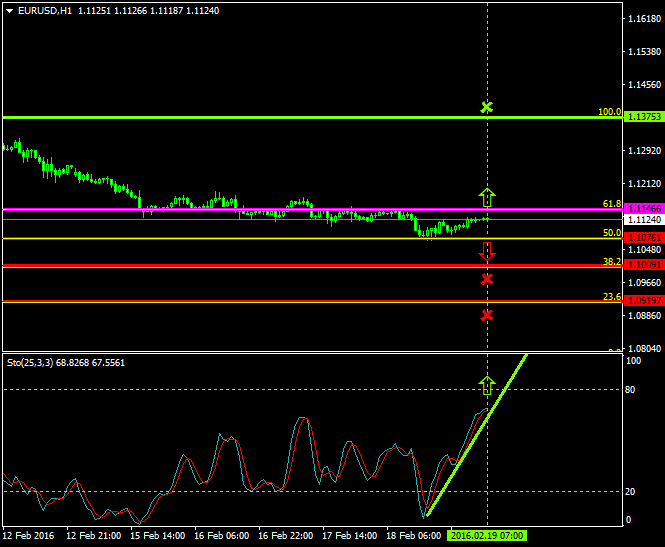

The bearish pressures on the EURUSD pair resumed and have forced the price to aggressively decline as low as 1.1076.

The price is now oscillating within a stable mode between the range of 1.1076 and 1.1146 respectively.

Today’s major pivot point level is 1.1146 an area where both the bulls and the bears will attempt to take control over the pair.

Probable Scenario

The Stochastic oscillator’s latest formation indicates that the price has greater chances to retrace to the upside even though the main and signal lines have almost approached the 80 level.

In the event where the buyers surpass the sellers in volume, the pair could once again rise to 1.1375, Fibonacci’s 100.0% provided though that initially the price breaks above the 1.1146 level.

Alternative Scenario

In contrast, in the scenario where the sellers increase their pressures and manage to force the price below the 1.1076 level, the pair could drop to 1.1009 and 1.0919.

Today’s Major Announcements

- The Producer Price Index (MoM) (Jan), the Producer Price Index (YoY) (Jan), and the European Council Meeting releases are expected to have a medium impact on the euro

- The Consumer Price Index Ex Food & Energy (YoY) (Jan) and the Consumer Price Index (YoY) (Jan) announcements are expected to have a strong impact on the U.S. dollar

Synopsis

- Probable trend (Bullish): 1.1146

- Bullish take profit target: 1.1375

- Stop loss target: 1.1076

- Alternative trend (Bearish): 1.1076

- Bearish take profit targets: 1.1009, 1.0919