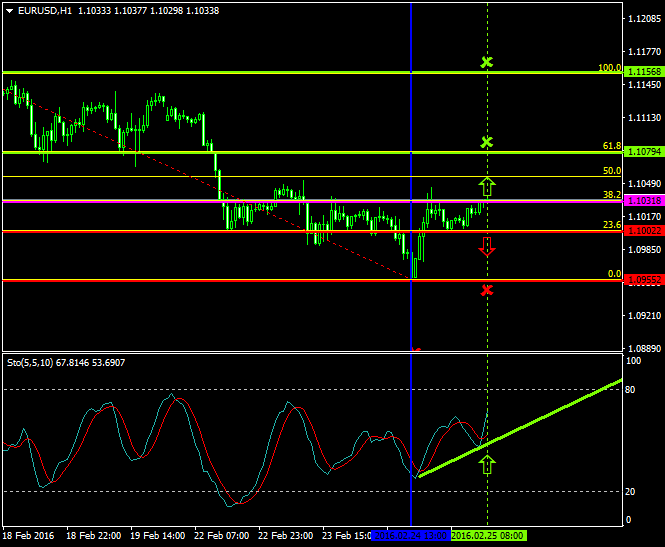

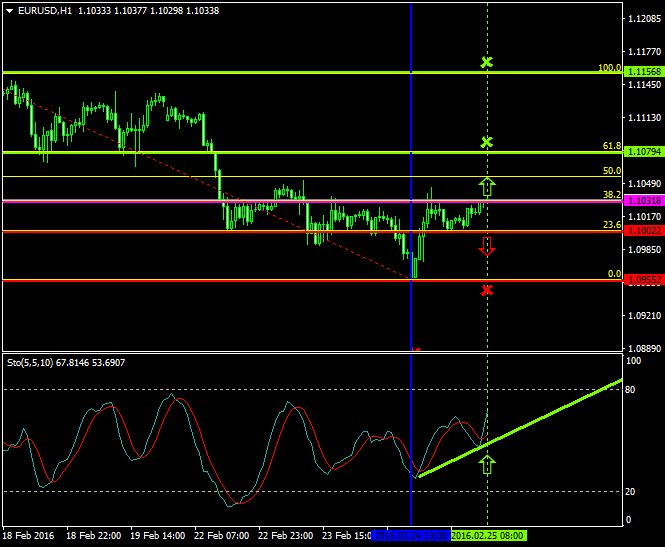

The sellers of the euro were the big profit makers since the 18th of February 2016, whereas the buyers lost ground, either having made a minor profit, in few cases, or faced huge losses.

From the 24th of February 2016 the pair has been mainly oscillating to the upside between the range of 1.0955 and 1.1031 respectively.

The price has currently stabilized close to the 1.1031 level which is today’s major pivot point area.

Probable Scenario

In the scenario where the buyers are able to withhold the pair above the 1.1031 zone, they could boost the price to upper areas such as the 1.1079 level, Fibonacci’s 61.8%, and the 1.1156 level, Fibonacci’s 100.0%.

Alternative Scenario

In contrast, in the condition where the sellers take advantage of today’s events, and the trend resumes to be bearish on the EURUSD, the price could drop down to the 1.0955 zone.

Today’s Major Announcements

- The Consumer Price Index (YoY) (Jan), the Consumer Price Index (MoM) (Jan), and the Consumer Price Index – Core (YoY) (Jan) releases are expected to have a medium impact on the euro

- The Durable Goods Orders (Jan) and the Durable Goods orders ex Transportation (Jan) announcements will likely have a strong impact on the U.S. dollar

Synopsis

- Probable trend (Bullish): 1.1031

- Bullish take profit targets: 1.1079, 1.1156

- Stop loss target: 1.1002

- Alternative trend (Bearish): 1.1002

- Bearish take profit target: 1.0955