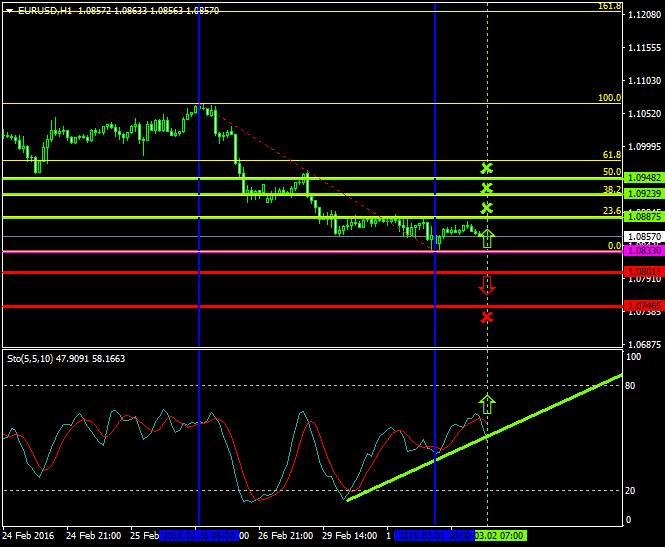

The price has been oscillating since yesterday’s trading session close to the 1.0887 zone and slightly above the 1.0833 level which is today’s major pivot point area.

The bullish and the bearish pressures are now equally distributed with both the buyers and the sellers attempting to take control over the pair.

Probable Scenario

In the event where the buyers are able to withhold the pair above today’s pivot point level, the 1.0833, they could likely lead the price to upper areas, such as the 1.0887, Fibonacci’s 23.6% and 1.0923, Fibonacci’s 38.2%, and 1.0948, Fibonacci’s 50.0%.

Alternative Scenario

Alternatively, in the condition where the bullish pressures are not strong enough to withhold the pair above the 1.0833 zone and the price drops below the 1.0801 area, the pair could thereafter decelerate to 1.0746.

Today’s Major Announcements

- The ADP Employment Change (Feb) and the Fed’s Beige Book announcements are expected to have a medium impact on the U.S. dollar

- The Producer Price Index (MoM) (Jan) and the Producer Price Index (YoY) (Jan) releases are expected to have a strong impact on the euro

Synopsis

- Probable trend (Bullish): 1.0833

- Bullish take profit targets: 1.0887, 1.0923, 1.0948

- Stop loss target: 1.0801

- Alternative trend (Bearish): 1.0801

- Bearish take profit targets: 1.0746