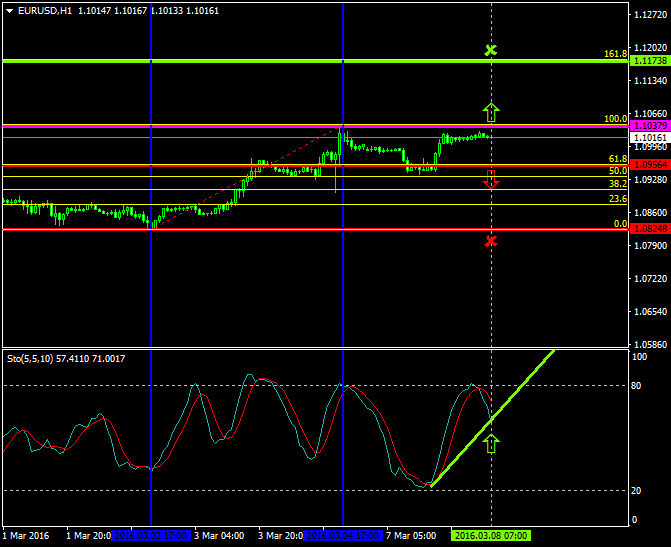

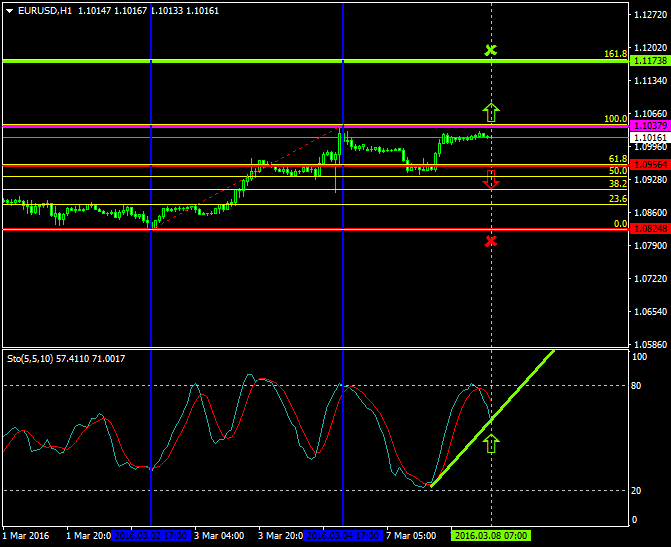

The euro and the U.S. dollar continue to oscillate within an uptrend formation between the range of 1.0956 and 1.1037 respectively.

Both the bulls and the bears will once again, in today’s trading session, place their pressures in their attempts of taking control over the price.

The upside pressures since the 2nd of March 2016 led the pair from as low as 1.0824, to as high as 1.1037 which is today’s major pivot area.

Probable Scenario

In the scenario where the EURUSD stabilizes above the 1.1037 area, the price could escalate as high as 1.1173 Fibonacci’s 161.8%.

The stochastic oscillator also indicates that the pair has greater chances of retracing to upper levels, even though the price has already approached the 80 zone.

Alternative Scenario

Alternatively, should the sellers take the lead and force the price below the 1.0956 area, the pair could decline as low as 1.0824.

Today’s Major Announcements

- The Gross Domestic Product s.a. (QoQ) (Q4) and the Gross Domestic Product s.a. (YoY) (Q4) announcements are expected to have a strong impact on the euro

- There are no any major releases on the U.S. dollar

Synopsis

- Probable trend (Bullish): 1.1037

- Bullish take profit target: 1.1173

- Stop loss target: 1.0956

- Alternative trend (Bearish): 1.0956

- Bearish take profit target: 1.0824