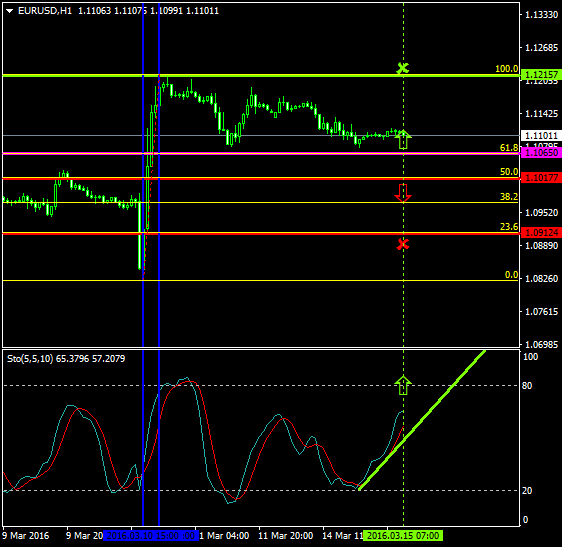

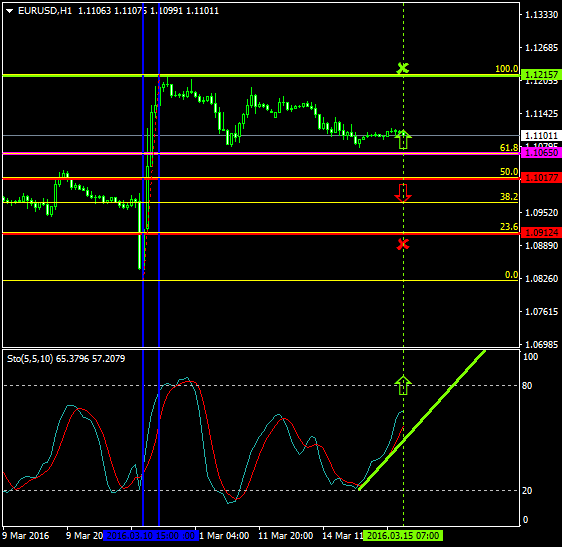

The EURUSD stabilized above the 1.1065 level Fibonacci’s 61.8% where both the buyers and the sellers will likely place pressures to take control over the pair’s price.

The price since the 10th of March 2016 dropped approximately 150 pips, from as high as 1.1215 to as low as 1.1065.

Probable Scenario

In the scenario where the pair retraces at the 1.1065 zone and the buyers take the lead, the price could escalate to 1.1215 Fibonacci’s 100.0%.

Even though the stochastic oscillator’s main and signal lines have already approached the 70 zone, this is not a barrier for the buyers in their attempts of placing greater pressures to the upside.

Therefore, the bulls could be in charge on the EURUSD for today’s trading session, unless the sellers have the ‘’appetite’’ to reverse the bullish condition into a bearish one.

Alternative Scenario

In contrast, in the event where the sellers exert a greater momentum and the pair moves below the 1.1017 zone Fibonacci’s 50.0%, the price could decelerate to 1.0912 Fibonacci’s 23.6%.

Today’s Major Announcements

- There are no any major releases that could have a major impact on the euro

- The Retail Sales (MoM) (Feb) announcement is expected to have a major impact on the U.S. dollar

Synopsis

- Probable trend (Bullish): 1.1065

- Bullish take profit target: 1.1215

- Stop loss target: 1.1017

- Alternative trend (Bearish): 1.1017

- Bearish take profit target: 1.0912