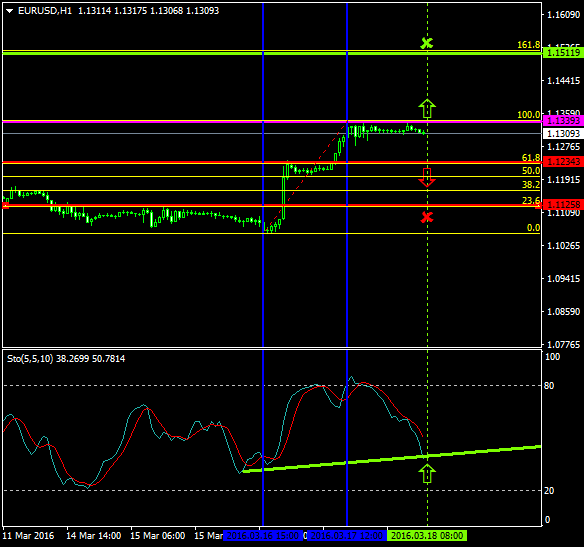

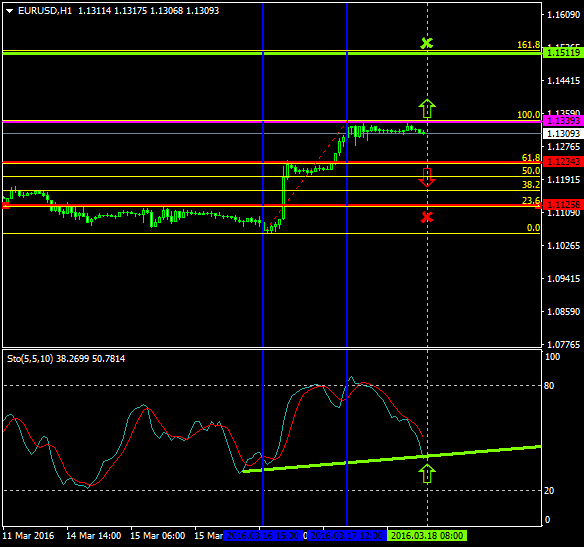

The EURUSD after escalating aggressively from as low as 1.1057 to as high as 1.1339 has now stabilized slightly below today’s major pivot point area, the 1.1339 level.

Stochastic oscillator’s latest formation shows a pattern of a steady appreciation at the 30 level where the pair is expected to retrace once again to the upside.

Probable Scenario

In the condition where the pair stabilizes above the 1.1339 level and the upside pressures somehow get more tensed, the price could rise to the 1.1511 zone, Fibonacci’s 161.8%.

Should the bulls gain control over the price in today’s session as well, then such a continuation confirms their successful and profitable upside attempts since the 16th of March 2016.

Alternative Scenario

Alternatively, in the event where the bearish pressures force the pair below the 1.1234 zone, the price could drop to 1.1125.

Today’s Major Announcements

- Germany’s Producer Price Index (MoM) (Feb), Germany’s Producer Price Index (YoY) (Feb), and euro zone’s Labour cost (Q4) releases are expected to have a medium impact on the euro

- Baker Hughes US Oil Rig Count release is expected to have a medium impact on the U.S. dollar

Synopsis

- Probable trend (Bullish): 1.1339

- Bullish take profit target: 1.1511

- Stop loss target: 1.1234

- Alternative trend (Bearish): 1.1234

- Bearish take profit target: 1.1125