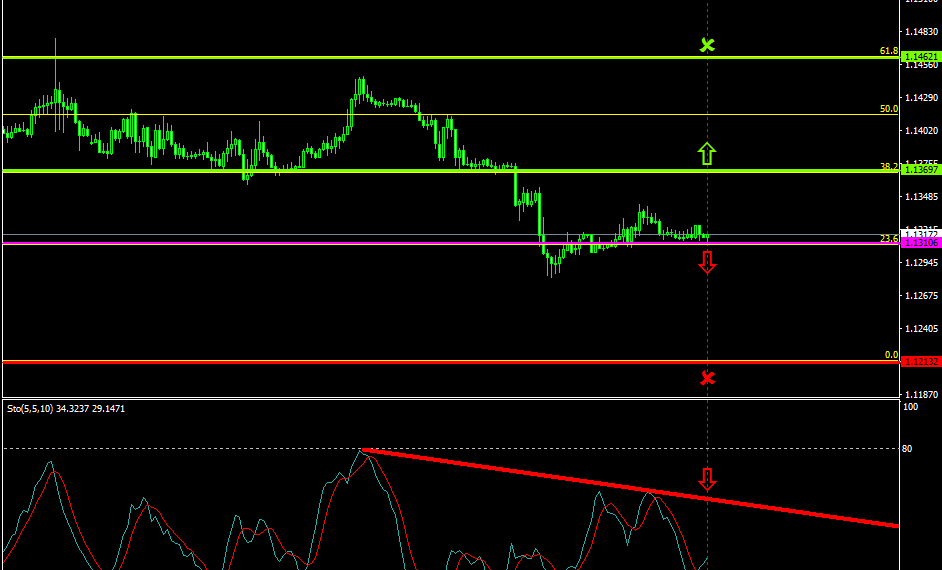

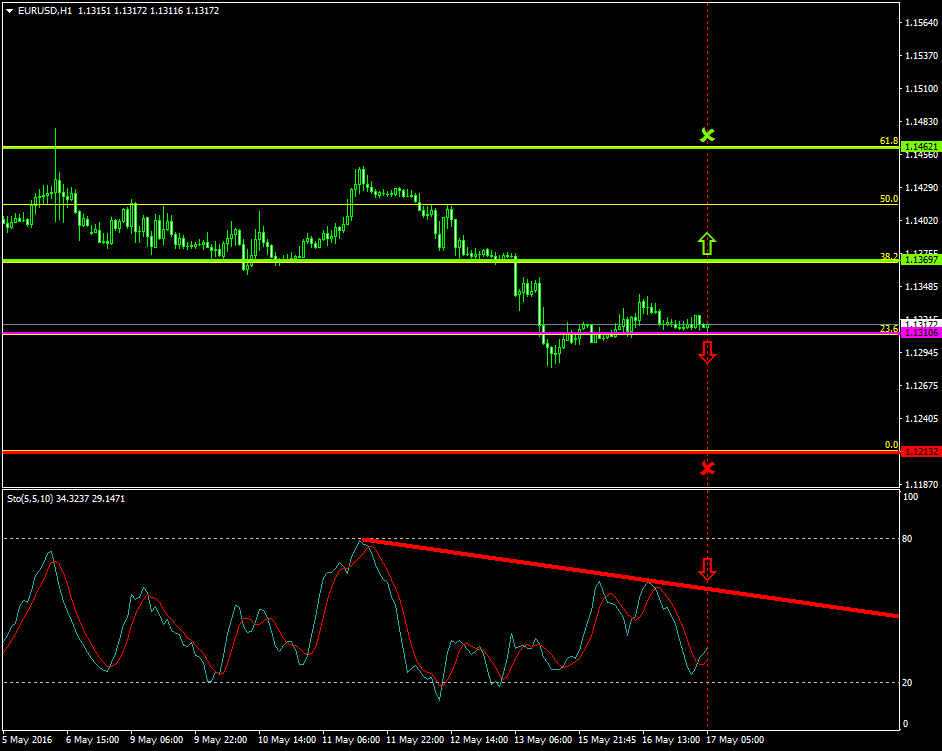

The pair has been recently oscillating between the range of 1.1462 and 1.1310 as the sellers attempted and were able to take control over the price.

The buyers, lately, placed greater pressures, since the 13th of May 2016, and stabilized the price at 1.1310. Today’s major pivot point area is the 1.1310 level.

Probable Scenario

The latest stabilization of the pair close to the 1.1310 area is a good indication that the price may retrace to the downside.

In the event where the pair drops, the sellers could lock their profit at 1.1213.

The Stochastic oscillator confirms the downtrend formation thus showing that the pair has greater probabilities of retracing downwards.

Alternative Scenario

In contrast, in the condition where the bullish pressures get more tensed and the pair breaks above the 1.1369 level, the price could rise to 1.1462.

Today’s Major Announcements

- Euro zone’s Trade Balance n.s.a (Mar) and Trade Balance s.a (Mar) announcements are expected to have a medium impact on the euro

- U.S.’s Building Permits (MoM) (Apr), the Housing Starts (MoM) (Apr), the Consumer Price Index Core s.a (Apr), the Consumer Price Index n.s.a (MoM) (Apr), the Consumer Price Index (MoM) (Apr), the Consumer Price Index Ex Food & Energy (MoM) (Apr), the Consumer Price Index Ex Food &Energy (YoY) (Apr), the Consumer Price Index (YoY) (Apr), the Capacity Utilization (Apr), and the Industrial Production (MoM) (Apr) releases are expected to have a medium impact on the U.S. dollar

Synopsis

- Probable trend (Bearish): 1.1310

- Bearish take profit target: 1.1213

- Stop loss target: 1.1369

- Alternative trend (Bullish): 1.1369

- Bullish take profit target: 1.1462