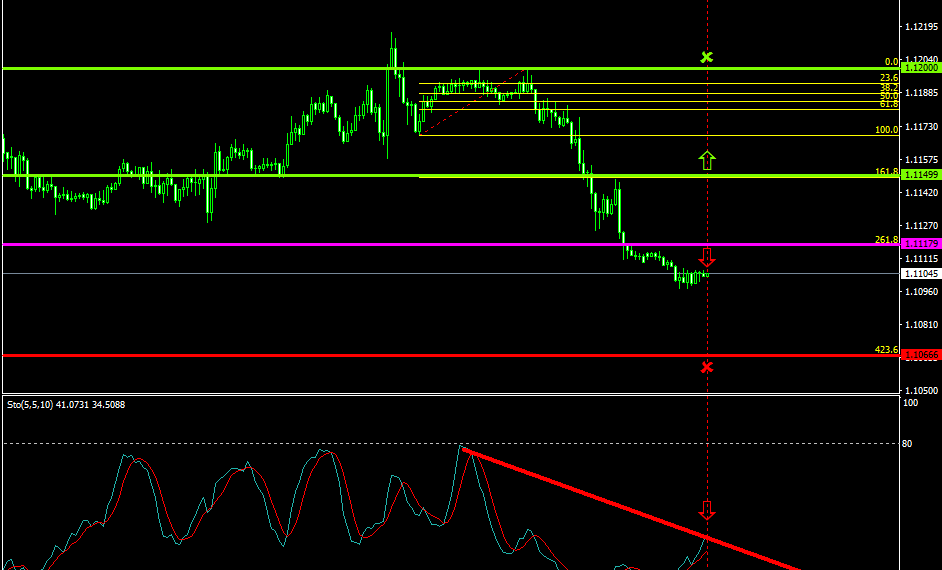

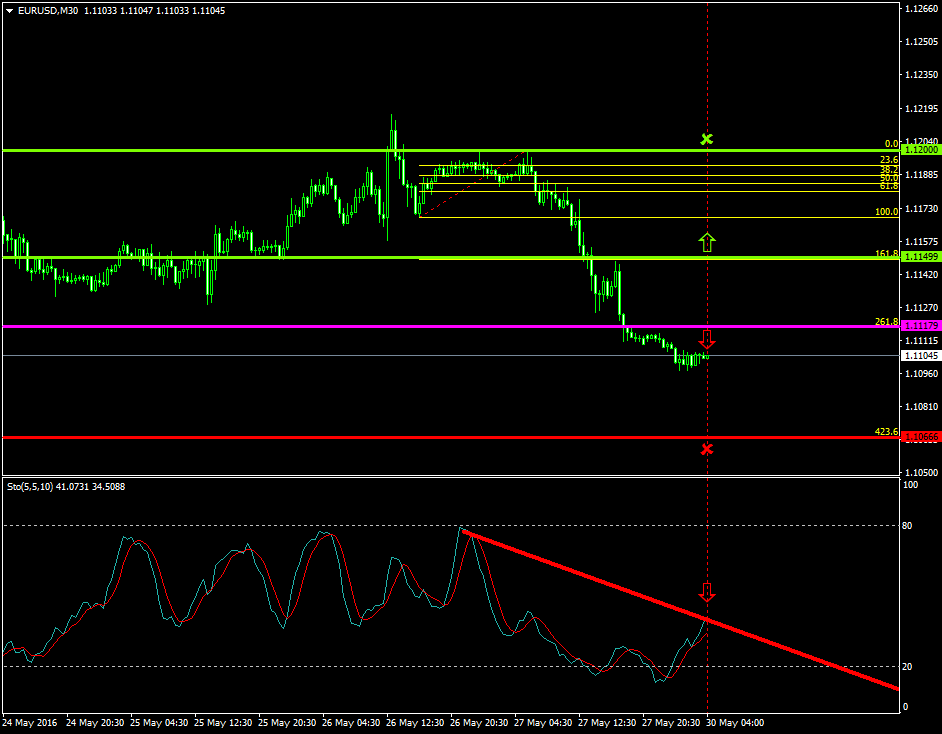

The EURUSD has been mostly oscillating, since the 27th of May 2016, within an aggressive bearish formation between the range of 1.1200 and 1.1097 respectively.

Both the buyers and the sellers are now placing strong pressures in their attempts of taking control over the pair’s price.

The price is now oscillating slightly below the 1.1117 zone which is today’s major pivot point area.

Probable Scenario

In the condition where the pair stabilizes below the 1.1117 area, the price could be forced to decline to lower zones such as the 1.1066 level.

The Stochastic oscillator also confirms that the price has greater chances to retrace and decline at the 40 level.

Alternative Scenario

Alternatively, should the buyers take the lead and boost the price above the 1.1149 area Fibonacci’s 161.8% the pair could appreciate as high as 1.1200.

Today’s Major Announcements

- Germany’s Consumer Price Index (YoY) (May), the Consumer Price Index (MoM) (May), the Harmonized Index of Consumer Prices (YoY) (May), and the Harmonized Index of Consumer Prices (MoM) (May) releases are expected to have a medium impact on the euro

- There are no any announcements on the U.S. dollar

Synopsis

- Probable trend (Bearish): 1.1117

- Bearish take profit target: 1.1066

- Stop loss target: 1.1149

- Alternative trend (Bullish): 1.1149

- Bullish take profit target: 1.1200