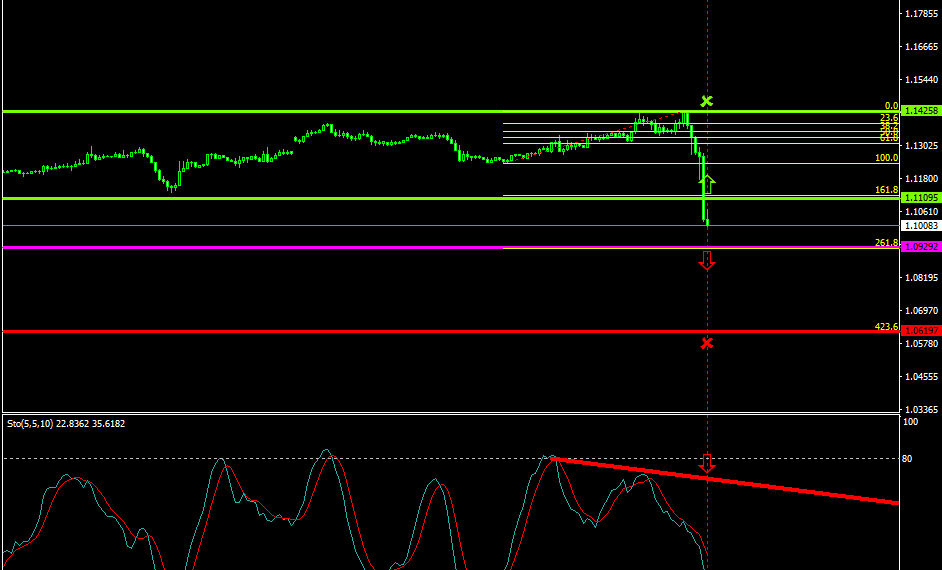

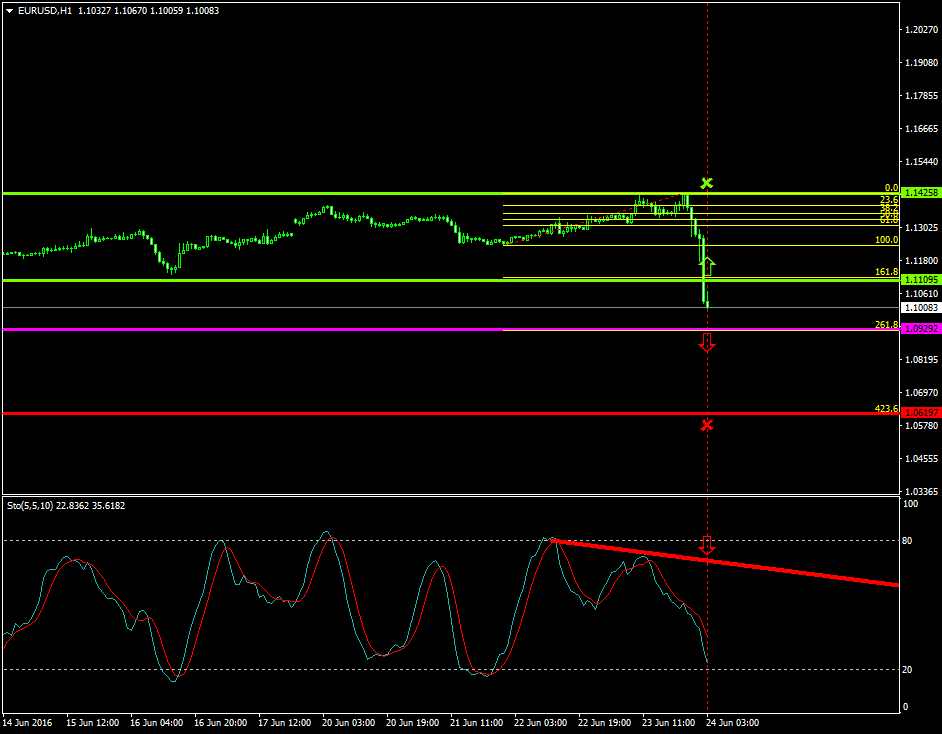

The pair stabilized above the 1.0929 zone, Fibonacci’s 261.8%, where the sellers will likely place pressures to take the lead over the EURUSD.

The price, since yesterday’s trading session, has aggressively dropped from 1.1425 and 1.1008.

Probable Scenario

The latest formation and stabilization close to the 1.0929 level is a good indication that the sellers may take control over the pair for today’s trading session as well.

In the event where the pair drops and the sellers take over, the price could decline to 1.0619.

The Stochastic oscillator indicates that the bearish pressures are more tensed and that the price has greater probabilities to decelerate.

Alternative Scenario

Alternatively, in the scenario where the bulls are able to place greater pressures and the pair breaks above the 1.1109 area, the price could rise to 1.1425 Fibonacci’s 0.0%.

Today’s Major Announcements

- The IFO – Business Climate (Jun), the IFO – Current Assessment (Jun), and the IFO – Expectations (Jun) releases are expected to have a medium impact on the euro

- The Durable Goods Orders ex Transportation (May), the Durable Goods Orders (May), and the Baker Hughes US Oil Rig Count releases are expected to have a medium impact on the U.S dollar

Synopsis

- Probable trend (Bearish): 1.0929

- Bearish take profit target: 1.0619

- Stop loss target: 1.1109

- Alternative trend (Bullish): 1.1109

- Bullish take profit target: 1.1425