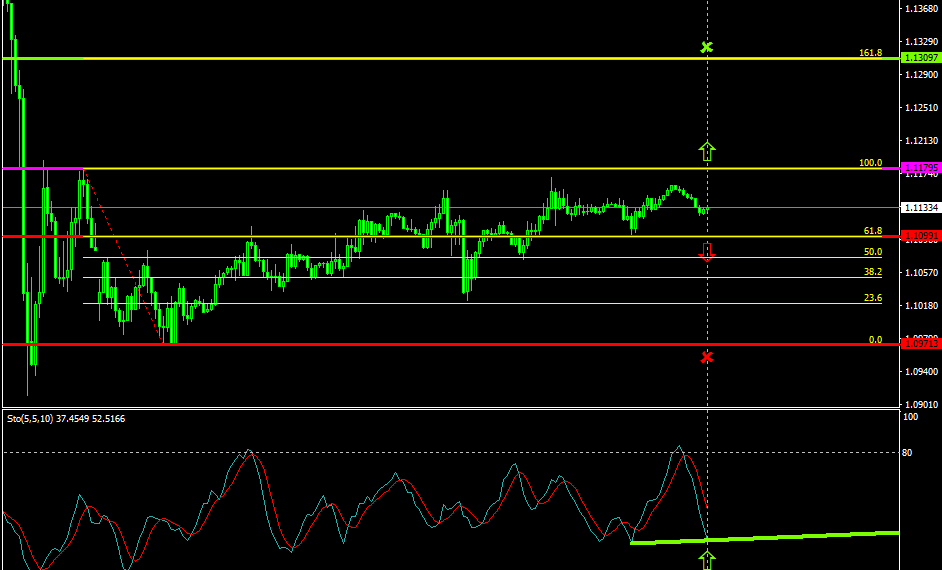

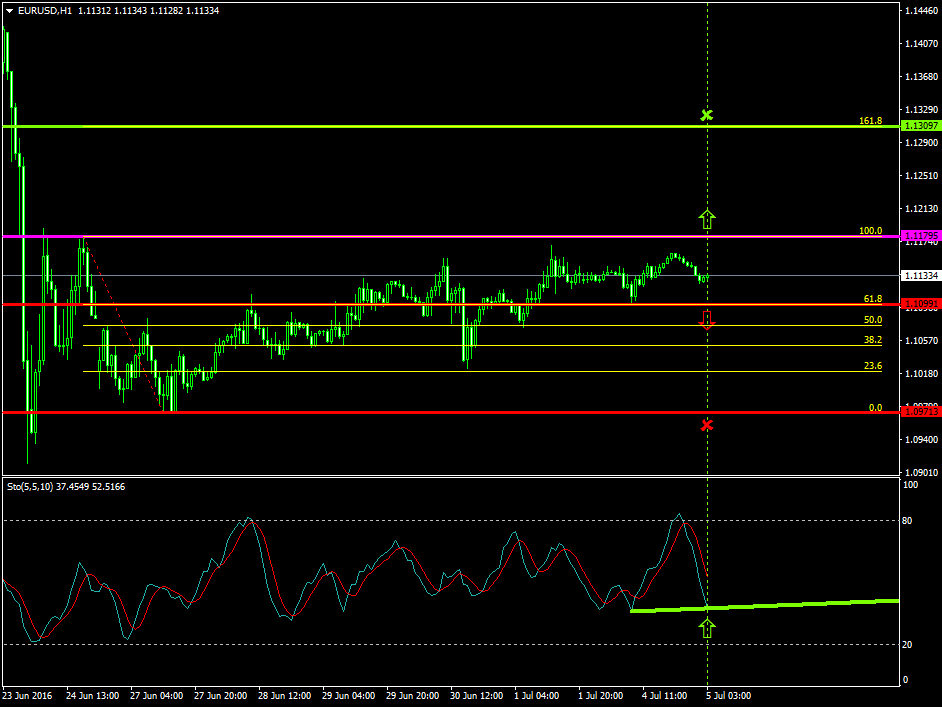

The upside pressures on the EURUSD got more tensed since the 27th of June 2016 where the price climbed from 1.0971 to 1.1179.

Today’s major pivot point area, the 1.1179 zone, is a critical level for the buyers in their attempts of boosting the price once again to the upside.

Probable Scenario

The latest stabilization of the price close to the 1.1179 level is a good indication that the bulls could likely exert momentum to retrace the pair upwards.

Stochastic oscillators’ formation signals that a probable bullish retracement at the 30 level has greater probabilities to occur.

In the event where the pair appreciates, the buyers could set their take profit target at 1.1309.

Alternative Scenario

Alternatively, a bearish break-out below the 1.1099 zone could signal that the sellers may exert far greater pressures to force the price to lower areas such as the 1.0971 level as their first target.

Today’s Major Announcements

- Spain’s Markit Services PMI (Jun), euro zone’s Markit Services PMI (Jun) and Markit PMI Composite (Jun) releases are expected to have a medium impact on the euro

- U.S.’s Factory Orders (MoM) (May) announcement is expected to have a medium impact on the U.S. dollar

Synopsis

- Probable trend (Bullish): 1.1179

- Bullish take profit target: 1.1309

- Stop loss target: 1.1099

- Alternative trend (Bearish): 1.1099

- Bearish take profit target: 1.0971