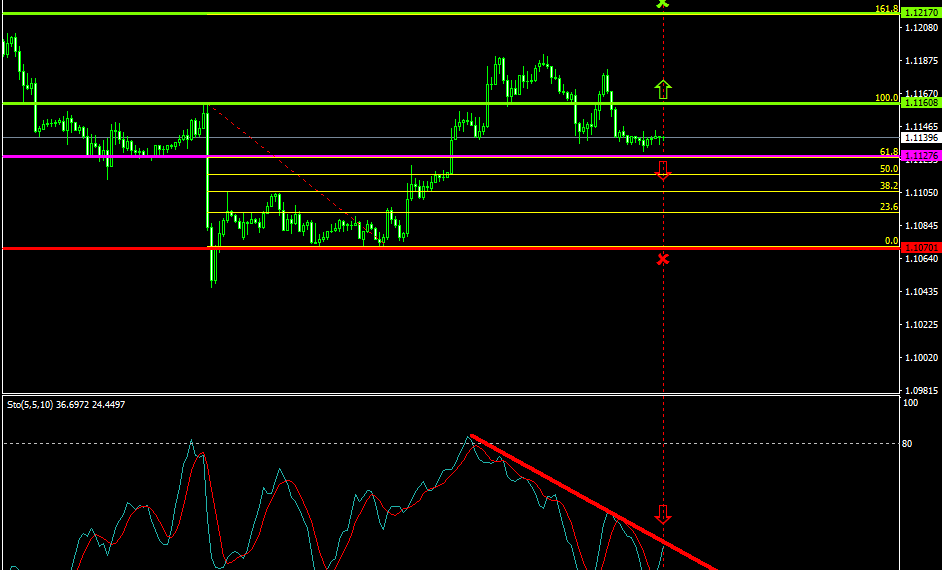

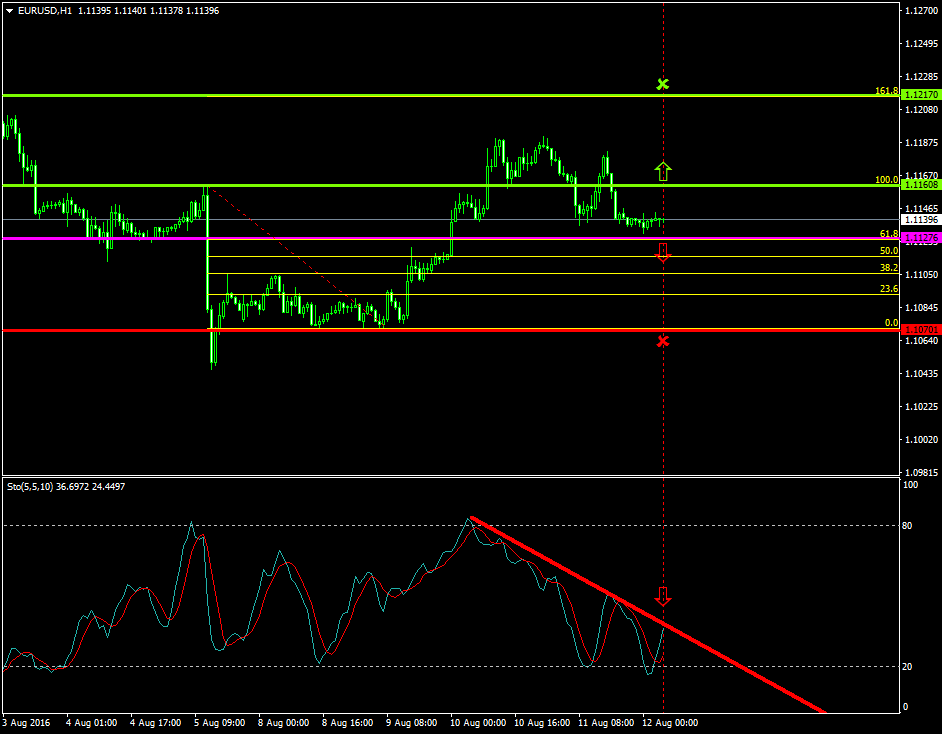

The EURUSD stabilized close to the 1.1127 zone, Fibonacci’s 61.8%, where the sellers will likely place more pressures to take control of the price.

The price, since the 9th of August 2016, has been oscillating within an upside formation between the range of 1.1070 and 1.1160 respectively.

Probable Scenario

The latest formation and stabilization close to the 1.1127 level is a good indication that the sellers may take control over the pair in today’s trading session as well.

In the event where the pair drops and the sellers take over, the price could decline to 1.1070 Fibonacci’s 0.0%.

The Stochastic oscillator’s main and signal lines indicate that the price has greater probabilities to decelerate at the 40 zone.

Alternative Scenario

Alternatively, in the scenario where the bulls are able to place greater pressures and the pair breaks above the 1.1160 area, the price could rise to 1.1217 Fibonacci’s 161.8%.

Today’s Major Announcements

- Germany’s Consumer Price Index (YoY) (Jul), the Gross Domestic Product w.d.a (YoY) (Q2), the Gross Domestic Product n.s.a (YoY) (Q2), the euro zone’s Gross Domestic Product s.a. (QoQ) (Q2), and the Gross Domestic Product s.a. (YoY) (Q2) announcements are expected to have a strong impact on the euro

- U.S.’s Retail Sales (MoM) (Jul) release is expected to have a strong influence on the U.S. dollar

Synopsis

- Probable trend (Bearish): 1.1127

- Bearish take profit target: 1.1070

- Stop loss target: 1.1160

- Alternative trend (Bullish): 1.1160

- Bullish take profit target: 1.1217