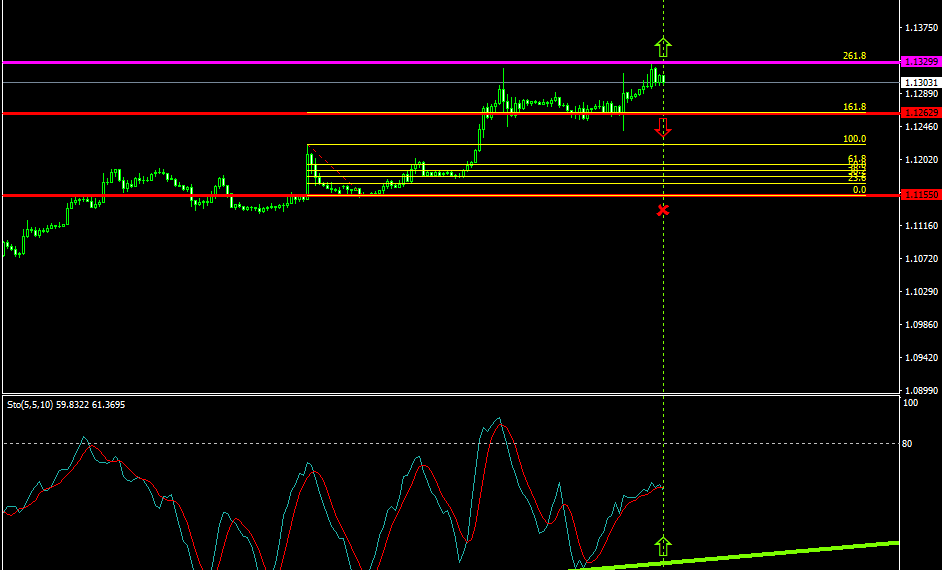

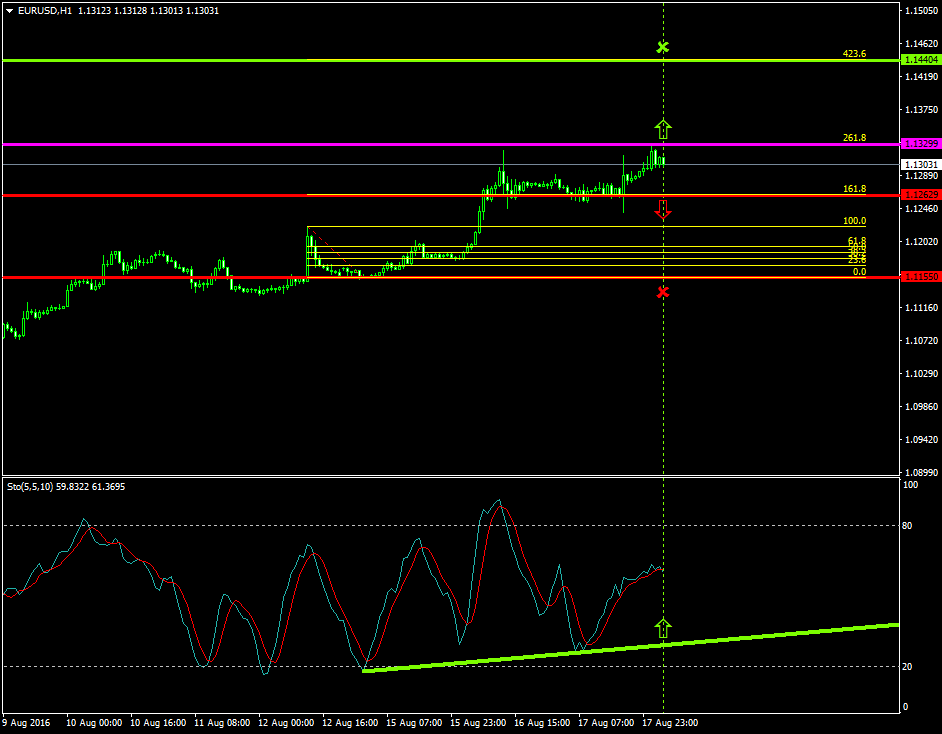

The euro and the U.S. dollar are lately oscillating within a bullish formation between the range of 1.1262 and 1.1329 respectively.

The bulls have placed strong pressures in their attempts of taking control over the price, and managed to lead the pair higher, from 1.1155 to 1.1329.

Probable Scenario

In the scenario where the EURUSD breaks above the 1.1329 area, the price could escalate as high as 1.1440, Fibonacci’s 423.6%.

The Stochastic oscillator indicates that the pair has greater chances of appreciating to upper levels at the 65 zone.

Alternative Scenario

Alternatively, should the sellers take the lead and force the price below the 1.1262 area, the pair could decline as low as 1.1155.

Today’s Major Announcements

- Euro zone’s Consumer Price Index (MoM) (Jul), the Consumer Price Index – Core (YoY) (Jul), the Consumer Price Index – Core (MoM) (Jul), the Consumer Price Index (YoY) (Jul), and the ECB Monetary Policy Meeting Accounts releases could have a strong impact on the euro

- The Initial Jobless Claims, the Philadelphia Fed Manufacturing Survey (Aug), and the CB Leading Indicator (MoM) (Jul) releases are expected to have a medium impact on the U.S. dollar

Synopsis

- Probable trend (Bullish): 1.1329

- Bullish take profit target: 1.1440

- Stop loss target: 1.1262

- Alternative trend (Bearish): 1.1262

- Bearish take profit target: 1.1155